4. In the next tab you will be able to choose the types of operations you will have.

Likewise, in the table on the right, you expect to have commercial relations with countries of the European Union.

In the middle tables, if you apply to your activity (ies) you should select, and in the "Opção por Regime de Tributação (IVA)" box, there is the other "underfloor". Select the "Regime Normal" only if you expect to bill over € 12,500. Otherwise, leave it blank.

2. In the second tab, put the codes of the activity you will be developing

3. In the "Atividade Exercida" tab, fill in the activity start date and the annual turnover you expect to have. And choose the option "No" in Annex E.

In the last table in the "Volume Anual Rendimentos Estimado (IRS)" please fill in the total volume you expect to have with all income under the IRS. In other words, in addition to the professional activity you are opening, other income you may have should indicate the total here. If you don't expect to have more income, put the same value.

CAT.B-REND. PROFISSIONAIS está normalmente associado a prestadores de serviços

CAT.B-REND. EMPRESARIAIS E PROFISSIONAIS atividades que englobem prestação de serviços e venda de bens

1. Start by choosing the type of service you will provide

The CAE Codes are those associated with business activities. The List is extensive. We advise you to do a search or consult the official source of INE.

Check this list.

The CIRS Codes are those used by service providers. You can consult the list here.

Any questions, check these FAQ.

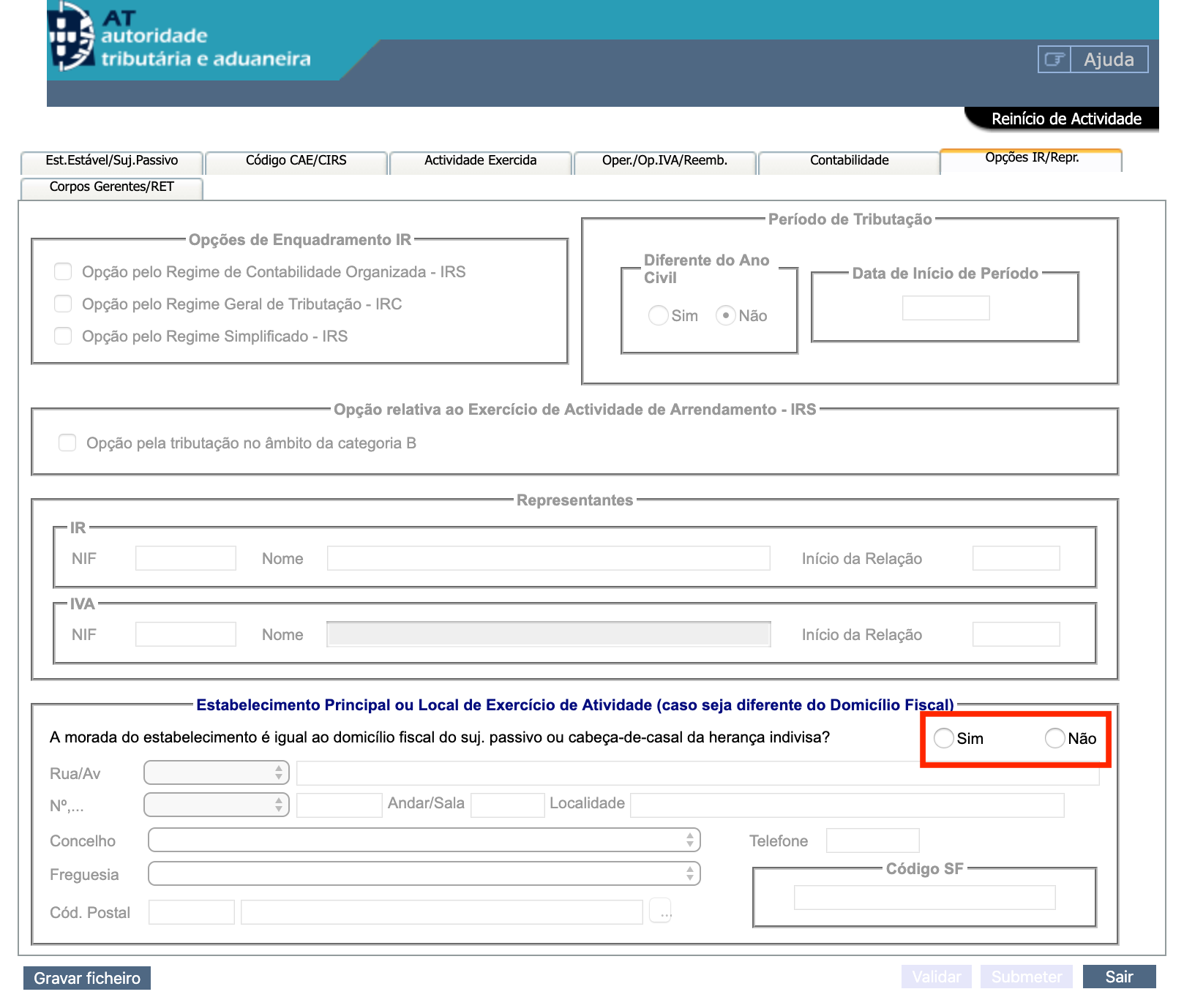

6. Finally, in the last tab, you must indicate whether your professional activity fits the activities exempt from VAT under article 9, or other special regimes. Otherwise, leave it blank.

If you expect to earn less than € 12,500 do not choose the option of the Regime Normal. It is one of the most frequent mistakes made by anyone who opens a business without professional advice. If you select this option you are obliged to submit the monthly VAT declaration even if you do not issue any invoice-receipt, as well as to invoice VAT if you do. Choose only if you expect to bill over € 12,500. The AIB option can be left unfilled.