How to fill out an Isolated Act: step-by-step

Green Receipt were a common name for simple electronic receipt. These are documents that can be issue by any citizen that doesn't have an open activity account as an Independent Businessman or as an Indepedent Worker. The maximium amount you could issue a single One Act was 25.000€.

This document has the purpose to charge a service done for a company or to serve as proof on a transmission of assets to a third party. In terms of IRS, they should be aknowledged in Anexo B. The process is free and can be done online through Portal das Finanças. Just follow these steps.

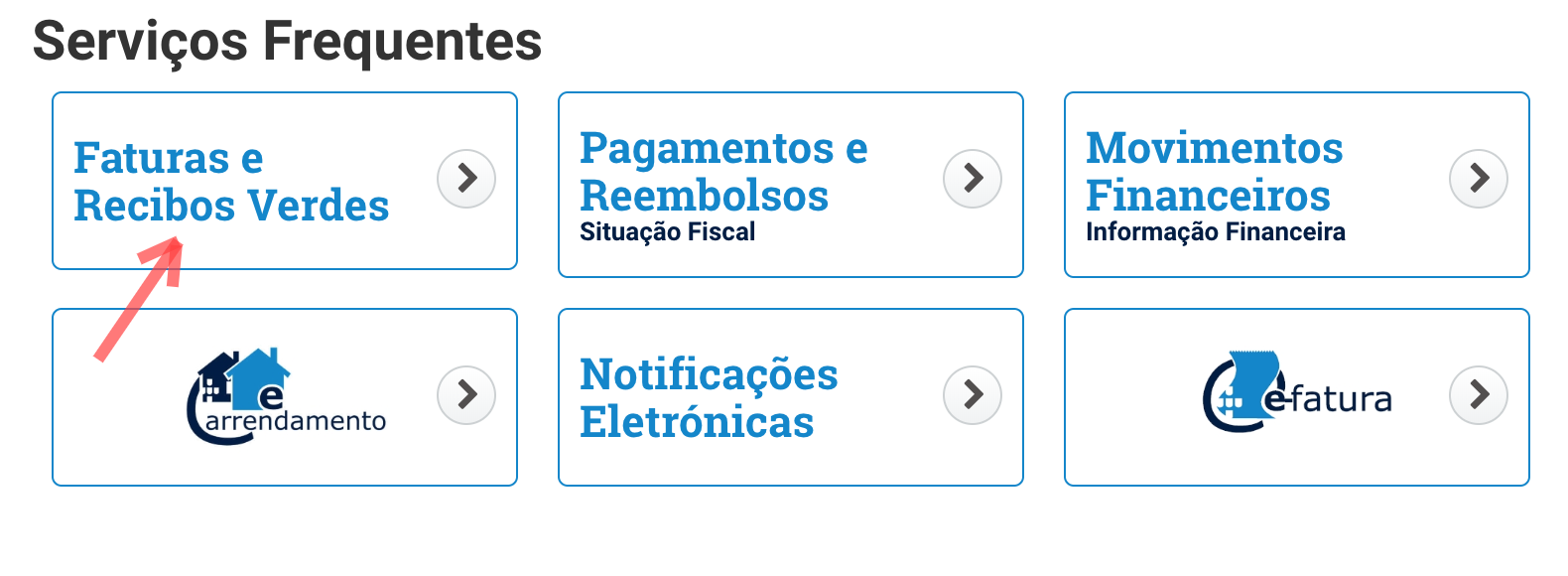

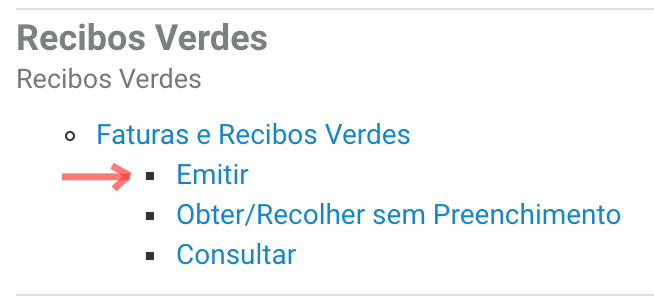

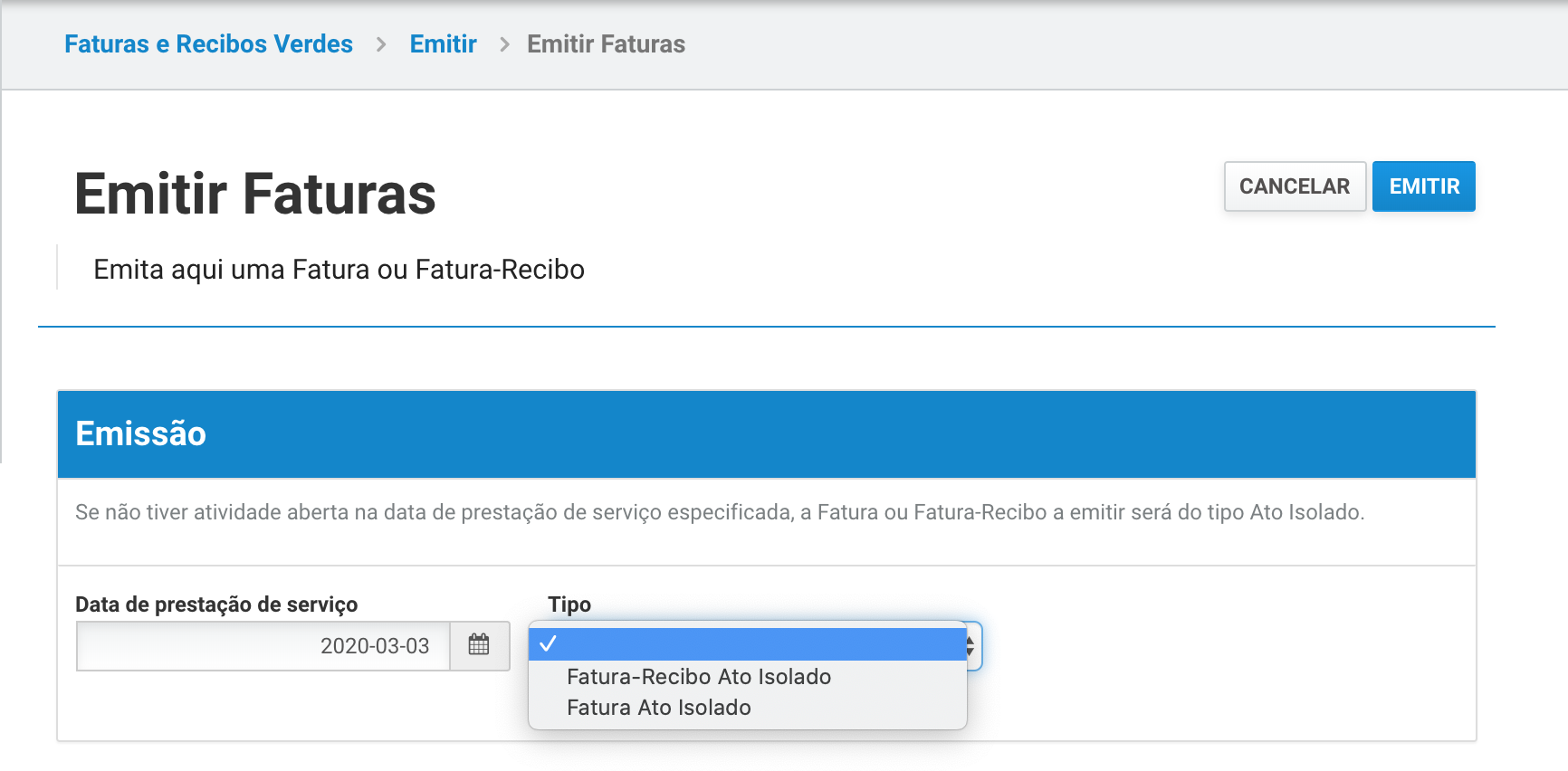

Search for: "Faturas e Recibos Verdes" and click "Emitir":

Escrito por Tiago Vieira da Silva

In this post, find a practical guide to issue a green receipt, for portuguese services.

Dica: a lista de todos os serviços é muito extensa. Faz CTR + F para procurar se estás num PC ou pesquisar ou localizar nas opções de partilha da página se estás em mobile

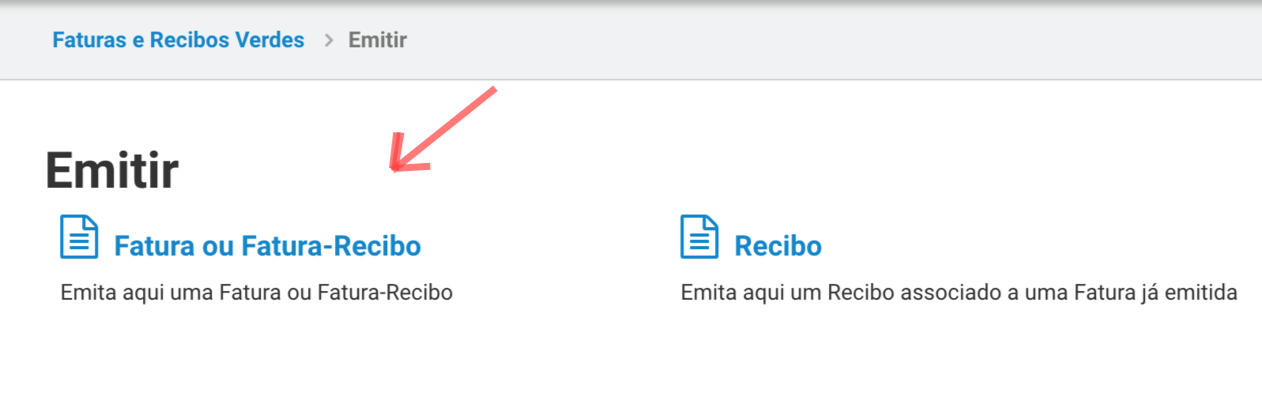

The main difference is on the way you will receive the value.

"Fatura-Recibo" is used in situation that you pay immediately for the product or service. It serves as a receipt.

"Fatura" is only the receipt that the service was done, but does not prove that the payment was done yet. It is not a proof that money was received.

When you use "Recibo", it is only the confirmation that you have received the value that you put on a previous "Fatura Ato Isolado". If you issue a "Fatura Ato Isolado" to another person, the other will only issue a "Receipt" to confirm that they have received the value.

"Fatura-Recibo" is used in situation that you pay immediately for the product or service. It serves as a receipt.

"Fatura" is only the receipt that the service was done, but does not prove that the payment was done yet. It is not a proof that money was received.

When you use "Recibo", it is only the confirmation that you have received the value that you put on a previous "Fatura Ato Isolado". If you issue a "Fatura Ato Isolado" to another person, the other will only issue a "Receipt" to confirm that they have received the value.

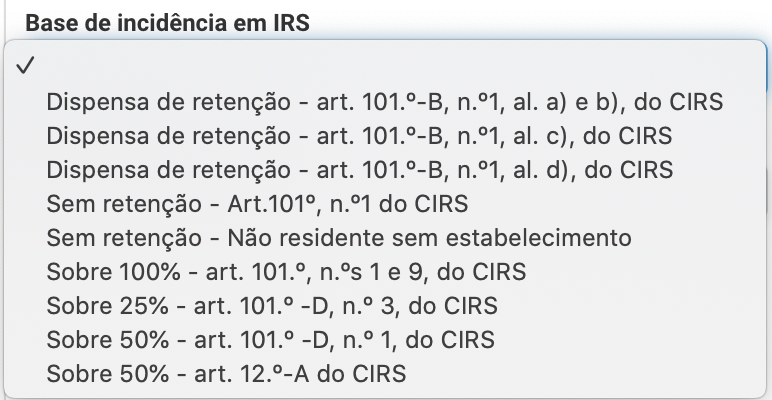

The next part is to focus on the

"Base de incidência em IRS". This is the value basic that will be used to calculate how much you need to pay for IRS (yearly tax).

"Base de incidência em IRS". This is the value basic that will be used to calculate how much you need to pay for IRS (yearly tax).

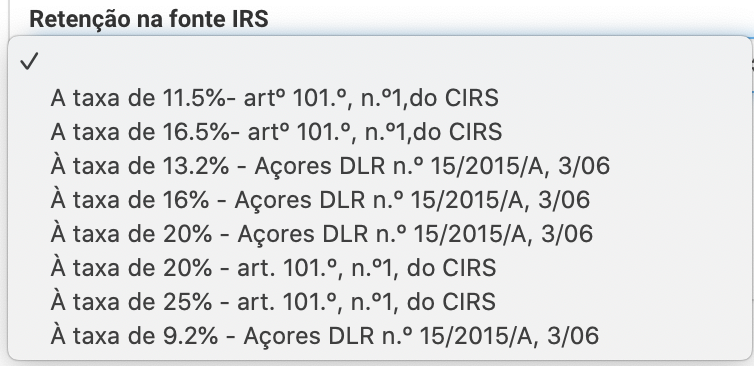

"Retenção na fonte IRS" - you can put a percentage aside for the IRS tax.

25% if the activity is included in this list (consult on the link);

20% if you are a non habitual resident, if you are developing activities related to scientific, artistic. Check these related activities on this list (legal reference: Portaria nº 12/2010).

16,5% regarding income from intellectual property (applied to writers), industrial property or specific information regarding the commercial, industrial or scientific experience.

11,5% for Independent Workers that are not included in the professional activities presented in article 151.º do CIRS

25% if the activity is included in this list (consult on the link);

20% if you are a non habitual resident, if you are developing activities related to scientific, artistic. Check these related activities on this list (legal reference: Portaria nº 12/2010).

16,5% regarding income from intellectual property (applied to writers), industrial property or specific information regarding the commercial, industrial or scientific experience.

11,5% for Independent Workers that are not included in the professional activities presented in article 151.º do CIRS

There are 9 options, but there are 2 frequently used and they apply to the majority of citizens:

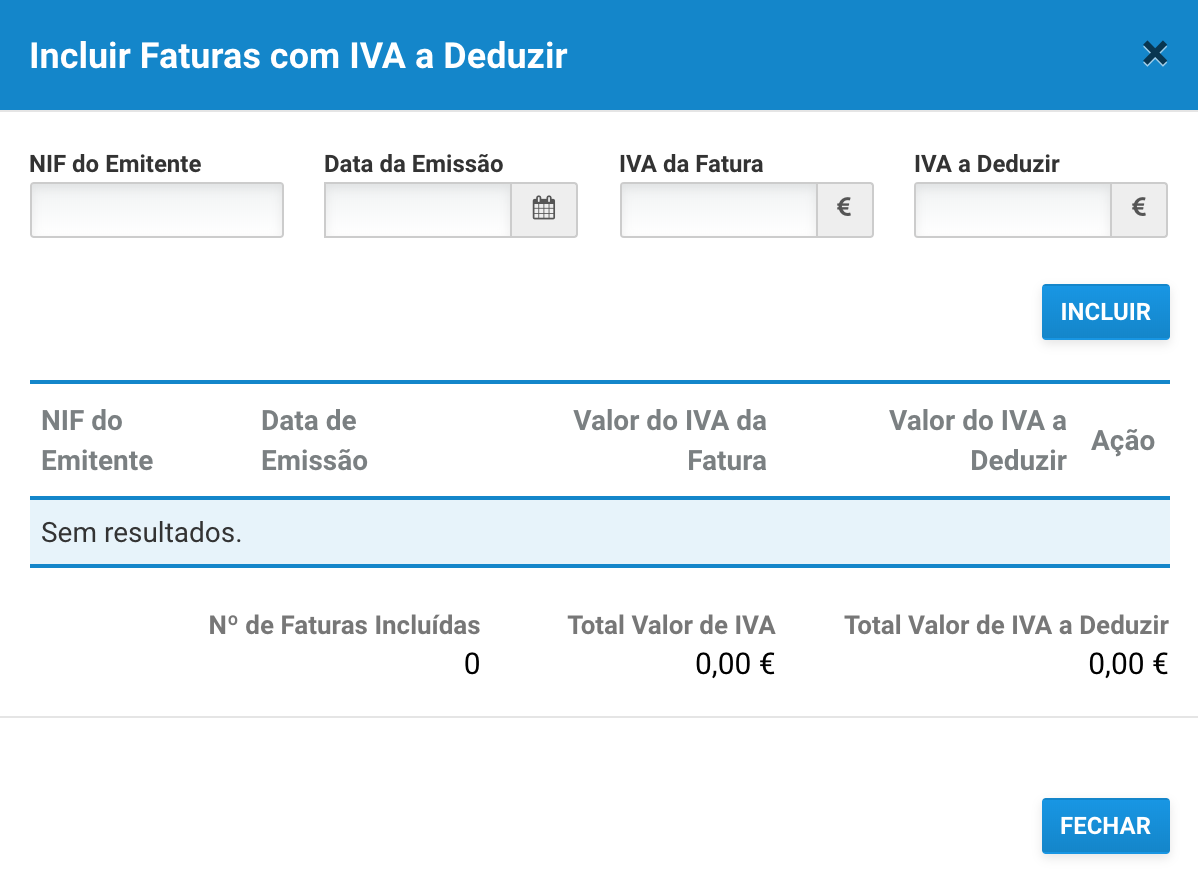

Before finishing the proccess, you can select the "Advanced Money / Adiantamentos", and you can also add receipts in "Incluir Faturas". These are expenses you had during the work you had done. This can be done so that you can pay less VAT. Just fill out the data required and click "close".

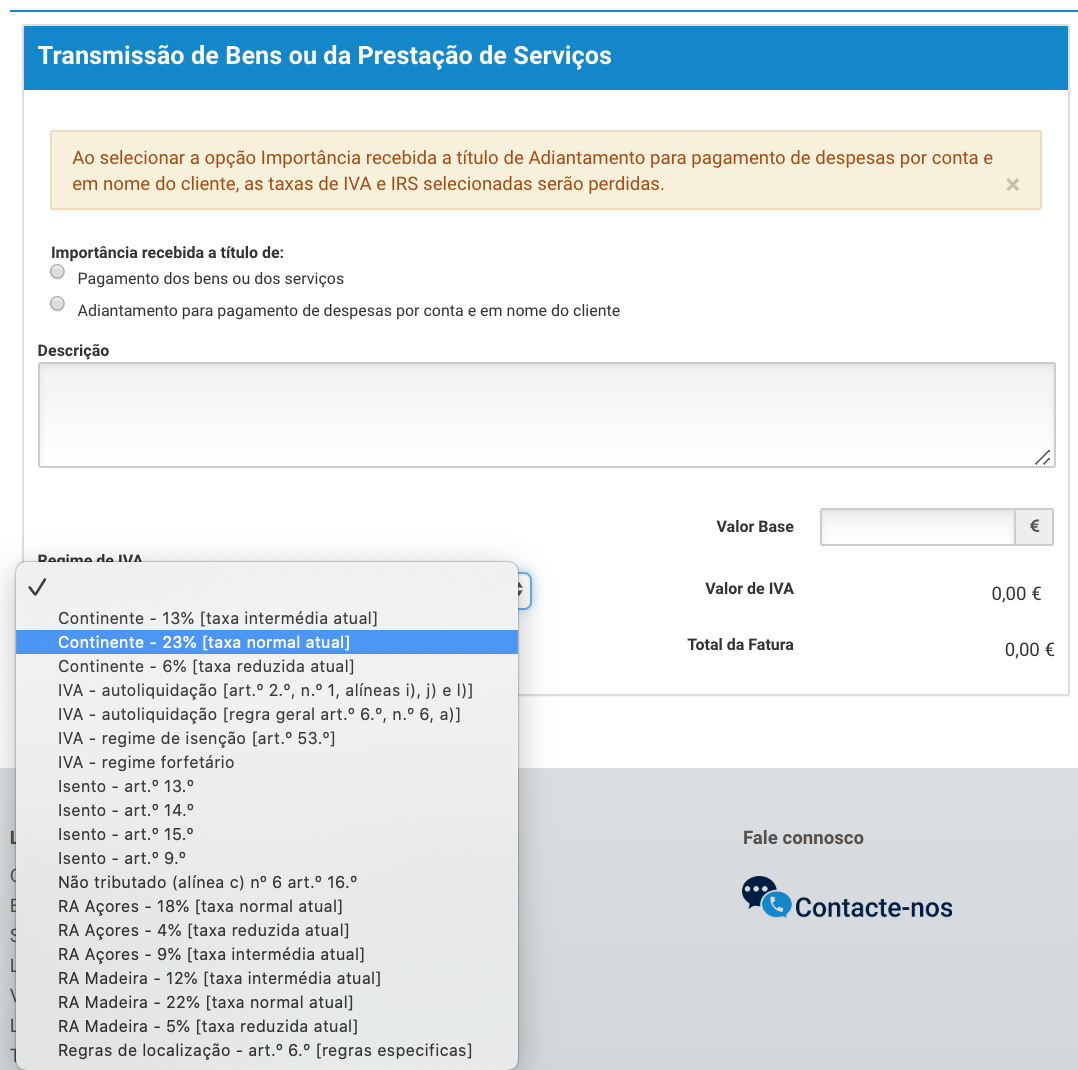

When you do a Isolated Act, you will need to pay VAY and regist it.

A escolha da taxa do IVA a aplicar depende do tipo de serviço ou bem. Se tiveres dúvidas sobre qual a taxa que se aplica ao teu caso entra em contacto connosco para te esclarecermos.

Não obstante, aqui ficam os casos mais frequentes:

Isento - art.º 9.º

Bens e serviços sujeitos a IVA

Os bens sujeitos à taxa normal são todos os que não constam na lista da taxa reduzia e intermédia.

Não obstante, aqui ficam os casos mais frequentes:

Isento - art.º 9.º

Bens e serviços sujeitos a IVA

Os bens sujeitos à taxa normal são todos os que não constam na lista da taxa reduzia e intermédia.

O Imposto de Selo apenas deverá ser preenchido em atos notariais. Normalmente fica em branco

1. Login Portal das Finanças (AT)

To login your account, fill out the NIF number and password. Use this link: Login Portal AT

To login your account, fill out the NIF number and password. Use this link: Login Portal AT

2. Go to the specific area

In the Main Menu, choose on the left side "Todos os Serviços".

3. Next step: select "Fatura ou Fatura-Recibo".

Then fill up the date of when you did your service or bought the assets. Choose"Fatura-Recibo Ato Isolado" ou "Fatura Ato Isolado".

Nota que também tens a opção de emitir um "Recibo". Explicamos em baixo.

4. Fill out the data

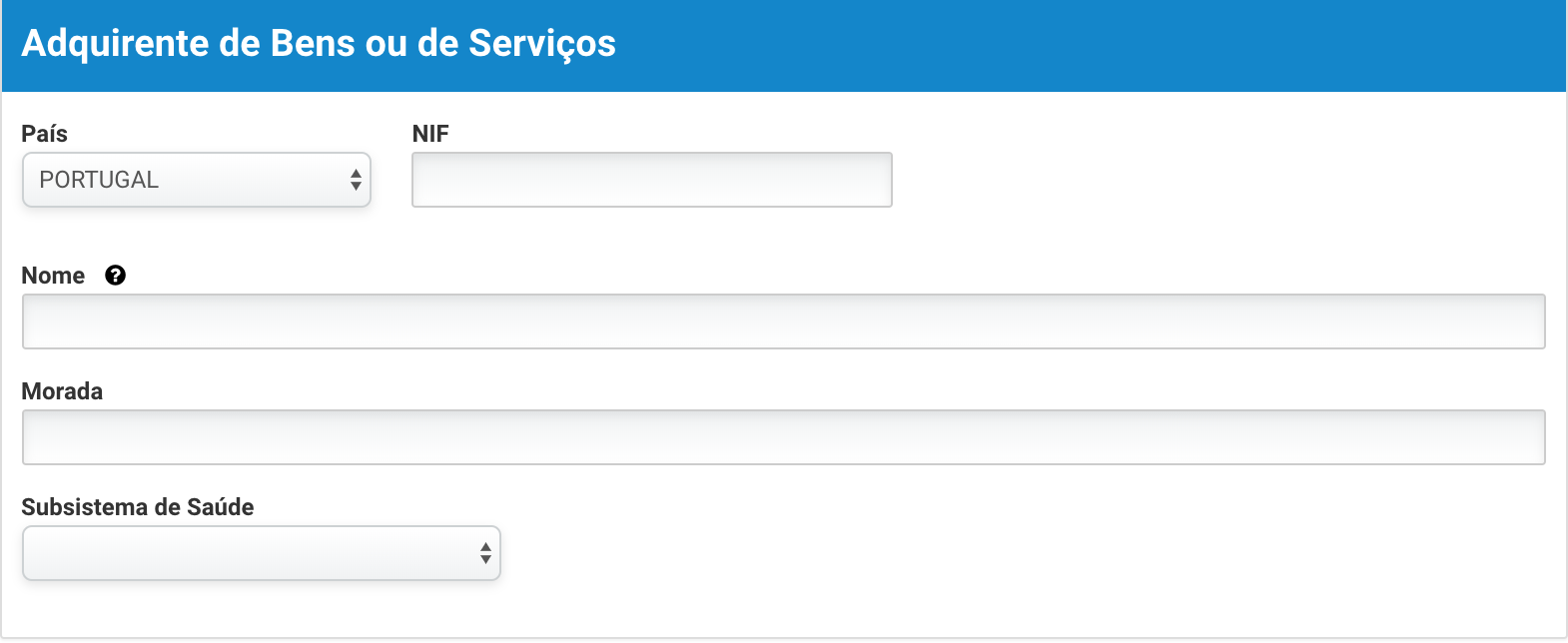

Most data is autocomplete. In the area "Adquirente de Bens ou de Serviços" put the client's data (Name, NIF, Address).

Reminder: the options may be different, depending on what you previously recorded (Fatura or Fatura-recibo).

a) Fatura

If you took this step, it means you haven't received the value from the client yet. So legally you haven't receive something so you cannot fill out the IRS area. The only tax you will need to pay right now is VAT / IVA. You must choose the IVA according to the type of service.

If you took this step, it means you haven't received the value from the client yet. So legally you haven't receive something so you cannot fill out the IRS area. The only tax you will need to pay right now is VAT / IVA. You must choose the IVA according to the type of service.

The first step is to choose the title of the service you are providing. Choose between a payment or a uphand payment. In the "Descrição", write down the description of the service. Then choose the VAT option according to your service and in "Valor Base" you should your service value minus VAT. Click in "Emitir" (issue) and confirm the data on the popup.

Once you receive the value from your client, you should issue the "Recibo" / Receipt.

b) Fatura-Recibo

With this document, you are confirming you already receive the money value from your client. So you have already receive, then you can liquidate IRS.

With this document, you are confirming you already receive the money value from your client. So you have already receive, then you can liquidate IRS.

In this step, choose the title of the service.

You also have an extra option: "Adiantamento" or "Advanced Money".

Use this option if the client chooses to pay you upfront before you delievered the work or the product.

You also have an extra option: "Adiantamento" or "Advanced Money".

Use this option if the client chooses to pay you upfront before you delievered the work or the product.

- "Dispensa de retenção - art. 101.º-B, n.º1, al. a) e b), do CIRS" - if the value to receive is below 12.500€ (art.º 53.º do CIVA)

- "Sobre 100% -art. 101.º, nºs 1 e 9, do CIRS" - if the value is higher than 12.500€

- "Sobre 100% -art. 101.º, nºs 1 e 9, do CIRS" - if the value is higher than 12.500€

A escolha da taxa do IVA é igual ao explicado em cima para a Fatura

6. Issue the receipt

At last, a final step is to verify all the data and click "Emitir". You have issued your Isolated Act, congratulations!

At last, a final step is to verify all the data and click "Emitir". You have issued your Isolated Act, congratulations!

Este campo só se aplica a prestações de serviços de saúde, nos casos em que o teu cliente seja um particular, pelo que se for o caso terás de referenciar o número e respetivo subsistema de saúde do cliente.

Another way is to go to the bottom of the homepage and select "Serviços Frequentes"